PRICES:

Detached Home Average: $917,387 ⬆️ 2%

Condo Average: $467,915 ⬆️13%

Semi-Detached Average: $776,343 ⬆️14%

Row Home Average: $726,545 ⬆️16%

SUPPLY:

2632 new listings came to market this past month.

This is 6% lower than last year at this time.

DEMAND:

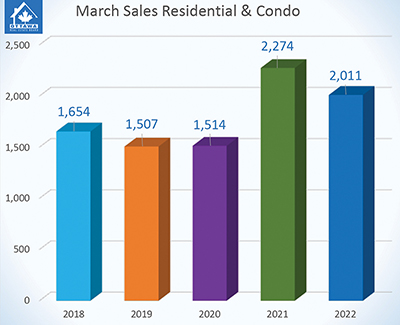

2011 residential properties sold this March, which is less than the last year 2021 (2274)

The 5 yr average is 1792

ABSORPTION RATE

How quickly new properties are sold and absorbed into the market

January 2022 – 48% absorption rate

February 2022 – 55% absorption rate

March 2022 – 55% absorption rate

THIS MEANS THE OTTAWA MARKET HAS JUST OVER 1/2 MONTH’S SUPPLY OF INVENTORY BEFORE WE ARE SOLD OUT IF NO NEW PROPERTIES COME TO MARKET.

I put together an exciting chart below. This highlights how much inventory we usually have in March (leftover from February and new listings) with a trend line showing how many sales we have.

The number of sales has increased over the past 5 years (although there is a slight decline from last year), yet the amount of inventory is significantly lower.

What to expect this month?

I hear news from my colleagues in the west and Toronto that there have been slowdowns in their markets. I haven’t experienced that AS much here in Ottawa. I am noticing micro shifts week by week. It’s a little like the predictability of our Canadian Spring Weather.

Starting in April, we had some significant changes in Ottawa: new Air BnB rules and Foreign Buyer tax (which was previously only in Toronto, now is Ontario wide). We have started to see those predicted interest rate increases, and buyers feel the fatigue.

Now it’s more important than ever to have a strategic plan and be guided or coached by someone who knows the market, watches the trends and has your best interests at heart.

I’m here to help!

Laura Seanor

RE/MAX Hallmark Realty Group🏡

OTTAWA, April 5, 2022 -Members of the Ottawa Real Estate Board sold 2,011 residential properties in March through the Board’s Multiple Listing Service® System, compared with 2,274 in March 2021, a decrease of 12 per cent. March’s sales included 1,493 in the residential-property class, down 12 per cent from a year ago, and 518 in the condominium-property category, a decrease of 10 per cent from March 2021. The five-year average for total unit sales in March is 1,792.

“Although the number of sales in March decreased from last year at this time, it was still a robust and busy start to the spring season. Transactions increased 42% over February (590 units) and were 12% higher than the 5-year average. Last March was unseasonably warm in comparison, and the lion-like weather that pervaded most of this March may have played a role. More likely, the lifting of some restrictions and opportunity for unfettered travel during the spring break had peoples’ attention turning towards other activities during the month,” states Ottawa Real Estate Board President Penny Torontow.

“March tends to be the early indicator of the spring resale market pace, so we anticipate April’s numbers will be a better indication of just how the spring market will perform, which tends to be the peak time of year for resales,” she adds.

“March tends to be the early indicator of the spring resale market pace, so we anticipate April’s numbers will be a better indication of just how the spring market will perform, which tends to be the peak time of year for resales,” she adds.

The average sale price for a condominium-class property in March was $479,405, an increase of 10 per cent from 2021, while the average sale price for a residential-class property was $853,615, increasing 13 per cent from a year ago. With year-to-date average sale prices at $831,122 for residential and $467,915 for condominiums, these values represent a 14 per cent and 13 percent increase over 2021, respectively.*

“Average prices continue on their upward trend, albeit only increasing 2-3% over February’s figures, the year over year percentage increases of 13-14% validate that the housing supply shortage will continue to put strong upward pressure on prices until that is remedied.”

“Last month saw 2,632 new listings enter the MLS® System, and although 6% lower than March 2021, this is still 4% (or 100 units) above the 5-year average. Residential-class property inventory is approximately 10.5% higher than last year at this time, with condominium-class inventory down 12%. Overall, we are just slightly over (.6%) a half month’s supply of inventory and require at least four months of inventory to be considered within a balanced market.”

“It is encouraging to see new inventory entering the resale market. However, these properties are being quickly absorbed due to the unrelenting high demand, and more listings are crucial to meeting this need,” Torontow advises.

“We appreciate the provincial government has introduced the first phase of its More Homes For Everyone Act to tackle the housing shortage by implementing measures, including working with municipalities to get homes built faster and increasing the Non-Resident Speculation Tax. This is a good start, and we are hopeful that with the application of these and further measures, Ottawa’s many potential home buyers waiting on the sidelines will finally be able to get a foothold in our local market.”

In addition to residential sales, OREB Members assisted clients with renting 1,291 properties since the beginning of the year compared to 1,079 by March 2021.