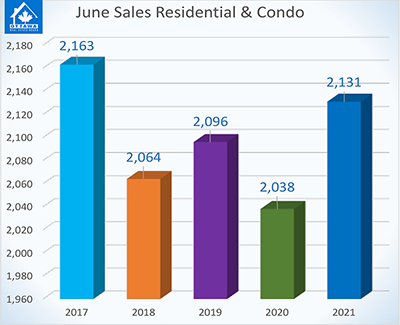

OTTAWA, July 6, 2021 – Members of the Ottawa Real Estate Board sold 2,131 residential properties in June through the Board’s Multiple Listing Service® System, compared with 2,038 in June 2020, an increase of 5 per cent. June’s sales included 1,647 in the residential-property class, up 2 per cent from a year ago, and 484 in the condominium-property category, an increase of 13 per cent from June 2020. The five-year average for total unit sales in June is 2,098.

“June’s resale market performed similar to a typical (pre-pandemic) June, with unit sales on par with the five-year average and a lower volume of activity compared to May, particularly in the last two weeks of the month. This is a normal tapering off as families turn their attention to end of school events and enjoying more outdoor recreation. This year, it also coincided with some easing of pandemic restrictions,” states Ottawa Real Estate Board President Debra Wright. “It will be interesting to watch the market over the summer to see if this normalization of the real estate sales ebb and flow is indeed the case moving forward. Last year, summer resales skyrocketed due to pent-up demand when the first lockdown ended.”

“Year-to-date sales are tracking 48% higher than last year at this time with 11,446 properties changing hands and are 16-18% higher than 2018 and 2019. Much of this increase is due to the increased activity in the first five months of 2021 compared to previous years. We have also seen an instrumental increase in new listings this year, and inventory levels for both residential and condominiums are higher than we’ve seen since 2017. However, we are still at a one month supply of housing stock, so we aren’t out of the woods yet.”

June’s average sale price for a condominium-class property was $435,198, an increase of 21 per cent from last year, while the average sale price for a residential-class property was $725,970, an increase of 26 per cent from a year ago. With year-to-date average sale prices at $734,357 for residential and $422,734 for condominiums, these values represent a 33 per cent and 20 percent increase over 2020, respectively.*

|

“For the moment, there are signs that we’ve reached a levelling out, especially as it relates to average prices which, in recent months, have not experienced the drastic increases of earlier in 2021, nor are we seeing a drop,” notes Wright.

“Properties are not moving as quickly as they were. Inventory has picked up; there is less scarcity and more choices – consequently, less upward pressure on prices. Additionally, we are noticing fewer of the multiple offer frenzy situations. Of course, many properties do still have multiple offers, but our REALTORS® are noticing that there are less of them on offer day.”

“This start of a perhaps equilibrium in the market is good news for Buyers, while Sellers are going to have to adjust to this new normal and be more strategic in their positioning. Whichever side of the transaction you are on, you will bode well by listening and heeding the advice of a professional REALTOR® who has their pulse on the day-to-day variabilities Ottawa’s resale market is experiencing,” Wright suggests.

OREB Members also assisted clients with renting 2,252 properties since the beginning of the year compared to 1,512 at this time last year.

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.