PRICES:

Residential Prices ⬇️ 5% from last year

Condominium Prices ⬇️ 4% from last year

SUPPLY is ⬆️

1598 new listings came to market this past month.

We do not usually see so many new properties in October. The exception is 2020, where several properties held off until the last quarter to be listed after the first few COVID lockdowns.

DEMAND is ⬇️

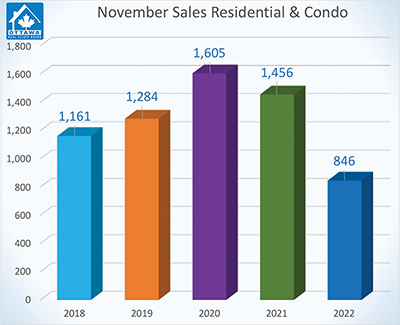

846 properties sold over the last month

Typically we see about 1300 homes sold in November. The lower number of sales is due to higher interest rates impacting buyers’ affordability and speculation about where prices could be going.

The $500,000-700,000 price points represents about 38% of the buyers. Thus the most in-demand range

This represents larger condos, rowhome & townhomes.

ABSORPTION RATE (Supply vs Demand)

How quickly are new properties sold and absorbed into the market

January 2022 – 48% absorption rate

February 2022 – 55% absorption rate

March 2022 – 55% absorption rate

April 2022 – 46% absorption rate

May 2022 – 39% absorption rate

June 2022 – 28% absorption rate

July 2022 – 22% absorption rate

August 2022 – 22 % absorption rate

September 2022 -20% absorption rate

October 2022 – 18% absorption rate

November 2022 – 17% absorption rate

The trend continues with a climb in inventory. We currently have 3.5 months available to buyers. This means no new properties were to be listed; we would be sold out in 3 and a half months. This feels like a lot of inventory, considering we had just over half a month of inventory in March 2022.

In total, there were just over 4800 properties available for purchase. In comparison

November 2021 – 3200

November 2020 – 3500

November 2019 – 4200

November 2018 – 5200

This shows that we are moving back to a balanced market. We have been here before, and this is the type of market Ottawa tends to be. Successful sellers are not looking at what their neighbours sold for at the height of the market, rather are looking at what the statistics show now. Chances are if you have been in your home for 3 more years, you still have earned a profit. Buyers have more choices now; however, clean, well-priced, well-staged homes are still selling fast.

What to expect this month?

December is typically a slower month, with only 600-800 sales and even fewer new listings. Buyers shopping right now have their finances in order and know that the holiday month is typically one of the best times of the year to get a “deal” I believe we will see a lot of new listings come to market in January 2023.

If you are starting to think about buying or selling in 2023, it’s never too early to start the process. Reach out, and let’s talk about your personal plan.

Laura Seanor

RE/MAX Hallmark Realty Group🏡

________________

Ottawa 30-second Real estate market update

Do you have questions about what it takes to sell or buy in Ottawa, Canada, successfully? Fill in the contact form and let’s chat.

OTTAWA, December 6, 2022 -Members of the Ottawa Real Estate Board (OREB) sold 846 residential properties in November through the Board’s Multiple Listing Service® (MLS®) System, compared with 1,456 in November 2021, a decrease of 42%. November’s sales included 658 in the residential-property class, down 39% from a year ago, and 188 in the condominium-property category, a decrease of 50% from November 2021. The five-year average for total unit sales in November is 1,270.

“November’s sales were expectedly low given the typical slowdown this time of year but they also reflect today’s economic conditions,” says Penny Torontow, OREB’s 2022 President. “This is not isolated to our local market. Globally, we’re still adjusting to the post-pandemic world and that affects demand, pricing, interest rates, cost of living, supply chain disruptions and more. As a result, those who can, are waiting and watching.”

|

By the Numbers – Average Prices*:

- The average sale price for a condominium-class property in November was $415,533, a decrease of 4% from 2021.

- The average sale price for a residential-class property was $680,031, decreasing 5% from a year ago.

- With year-to-date average sale prices at $774,422 for residential units and $454,436 for condominiums, these values represent an 8% increase over 2021 for both property classes.

“What’s concerning about the current market is the impact on first-time homebuyers,” says Torontow. “The marked decrease in condo sales, for example, signals that even entry-level properties are being affected. Fluctuating markets, paired with the stress test, are keeping first-time buyers on the sidelines in a tight rental market—with MLS® rentals increasing 27% this year over last.”

By the Numbers – Inventory & New Listings:

- Months of Inventory for the residential-class properties has increased to 3.5 months from 0.9 months in 2021.

- Months of Inventory for condominium-class properties has increased to 3.4 months from 1.1 months in 2021.

- November’s new listings (1,598) were 12% higher than 2021 (1,429) and down 22% from October 2022 (2,046). The 5-year average for new listings in November is 1,398.

“With nearly four months of inventory and an average 30 days on market, Ottawa now has a balanced resale market, slightly tipping toward the buyers,” says Torontow. “Sellers are well-advised to work with a REALTOR® who has hyper-local knowledge about specific neighbourhoods, appropriate price points and ideal timing. Prices are adjusting but real estate is a long-term investment. It’s the same reason I tell buyers to marry the house and date the rate.”

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.